grundor.ru

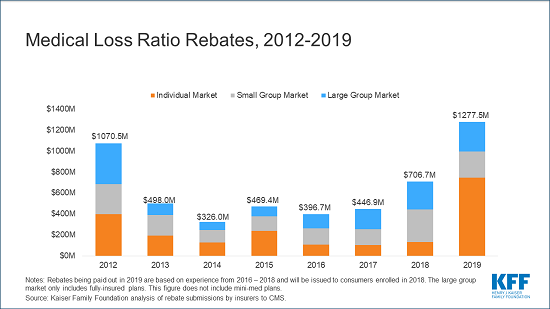

Learn

Ambetter Cost

We want to help you find the Ambetter health plan that best fits your budget and your health needs. Use the filters below to narrow your search results and. Ambetter Health currently serves million members, offering a variety of plans and healthcare services to meet our member's health needs. Ambetter Health offers Marketplace insurance plans with different coverage and benefit options, and premium levels. Learn more about our plan options. This helps lower the costs of your copays, deductibles and coinsurance. So, if you are eligible for a subsidy and cost sharing, Silver plans offer the highest. She wants a health plan that keeps her covered but costs her less. Lee picks a plan with a lower monthly premium payment. She knows it will cost more to see a. As an Ambetter Health member, you can enjoy discounts and special rates on exciting products and services. With Ambetter Perks find exclusive deals on. Your Ambetter Value Plan is designed to give you one convenient go-to resource for all your care: your Medical Group. Out-of-pocket payment reductions are available on Ambetter Health Silver Health Insurance Marketplace plans. Click here to find out if you are eligible. When you shop for plans on the Washington Health Exchange, you'll see different plan tiers with different premium amounts and costs for medical services. We want to help you find the Ambetter health plan that best fits your budget and your health needs. Use the filters below to narrow your search results and. Ambetter Health currently serves million members, offering a variety of plans and healthcare services to meet our member's health needs. Ambetter Health offers Marketplace insurance plans with different coverage and benefit options, and premium levels. Learn more about our plan options. This helps lower the costs of your copays, deductibles and coinsurance. So, if you are eligible for a subsidy and cost sharing, Silver plans offer the highest. She wants a health plan that keeps her covered but costs her less. Lee picks a plan with a lower monthly premium payment. She knows it will cost more to see a. As an Ambetter Health member, you can enjoy discounts and special rates on exciting products and services. With Ambetter Perks find exclusive deals on. Your Ambetter Value Plan is designed to give you one convenient go-to resource for all your care: your Medical Group. Out-of-pocket payment reductions are available on Ambetter Health Silver Health Insurance Marketplace plans. Click here to find out if you are eligible. When you shop for plans on the Washington Health Exchange, you'll see different plan tiers with different premium amounts and costs for medical services.

Learn more about our affordable healthcare plans and compare each plan's monthly premium payment and out-of-pocket expenses. Find the Ambetter Health plan that. Msg & data rates may apply. You can opt-out at any time. Disclaimer: By submitting your information you agree that we may contact you at the above-listed. As an Ambetter Health member, you can enjoy discounts and special rates on exciting products and services. With Ambetter Perks find exclusive deals on. This table only shows the cost for in-network providers. If you only Ambetter from Arkansas Health &. Wellness (QualChoice). Ambetter from Arkansas. Get Affordable Health Insurance Plans from Ambetter Health. Shop for Health Insurance Coverage to Fit Your Needs & Budget. Buy Your Plan Today. Ambetter from Buckeye Health Plan offers quality, affordable health insurance in Ohio that fits your needs and budget. Apply on the state Marketplace today! cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided separately. This is only a. Plan Brochures & Summaries of Benefits & Coverage ; Ambetter Balanced Care 4, Ambetter Balanced Care 4 Standard Cost Share, WA ; Ambetter Balanced. Ambetter Health currently serves million members, offering a variety of plans and healthcare services to meet our member's health needs. Compare Ambetter from Magnolia Health Plan plans in Mississippi, at no cost to you. Ready to start reviewing your options? HealthMarkets can help! Get. Don't let high health care costs hold you back. Our family health insurance plans offer affordable rates and top-notch coverage. Request a quote today. As an Ambetter Health member, you can enjoy discounts and special rates on exciting products and services. With Ambetter Perks find exclusive deals on. Ambetter offers quality, affordable health insurance in Tennessee that fits your needs and budget. Find a plan that meets your needs and apply online today. Ambetter offers lower premiums in bronze, silver and gold coverage categories with a full-price (unsubsidized) premium compared to BCBS of Texas. Plan Brochures & Summaries of Benefits & Coverage ; PremierSilver, Premier Silver Limited Cost Share, MO ; PremierSilver, Premier Silver 73% AV. Don't let high health care costs hold you back. Our family health insurance plans offer affordable rates and top-notch coverage. Request a quote today. Dental Coverage: Benefits that help pay for the cost of visits to a dentist Ambetter from Peach State Health Plan is underwritten by Ambetter of. Pay your premium to keep the coverage you deserve. Pay Learn more about Ambetter from NH Healthy Families low cost plans that meet your budget. Save on health insurance costs, like co-payments, when you use In-Network providers on covered services in your Ambetter health insurance plan. Ambetter Health offers affordable Health Insurance Marketplace plans. At Ambetter Health, we provide you with the benefits, tools, and coverage you need.

Best Cfp Study Materials

These 7 comprehensive study books are the core of your review study plan. Each book contains complete reference outlines, application questions, relevant. The books for all seven courses in the Financial Planning program are listed below. You can enroll in your course with the book included, at a discount, or you. Check out Kaplan Financial Education's FREE study materials to get you started on your CFP Exam. Become a CFP® professional with our CFP® exam prep that offers unmatched expertise to power your financial planning career. Compare Top 4 Online CFP® Education Programs* ; Exam Review Options, Self-Study materials with (or without) In-Person or Virtual Review Classes are available. Each of the 13 main chapters in CFP Certification Exam Study Guide - Certified Financial Planner comes with an optional Practice Test, as well as an overall. Be prepared for exam day with resources designed to solidify your knowledge and hone your test-taking skills. Exam Prep Materials. CFP® Exam Audio Review. The best CFP study materials in Canada | Exam Success. CFP practice questions and study notes. For the convenience of those pursuing certification, CFP Board has compiled a list of exam review course providers that may help in your exam preparation. These 7 comprehensive study books are the core of your review study plan. Each book contains complete reference outlines, application questions, relevant. The books for all seven courses in the Financial Planning program are listed below. You can enroll in your course with the book included, at a discount, or you. Check out Kaplan Financial Education's FREE study materials to get you started on your CFP Exam. Become a CFP® professional with our CFP® exam prep that offers unmatched expertise to power your financial planning career. Compare Top 4 Online CFP® Education Programs* ; Exam Review Options, Self-Study materials with (or without) In-Person or Virtual Review Classes are available. Each of the 13 main chapters in CFP Certification Exam Study Guide - Certified Financial Planner comes with an optional Practice Test, as well as an overall. Be prepared for exam day with resources designed to solidify your knowledge and hone your test-taking skills. Exam Prep Materials. CFP® Exam Audio Review. The best CFP study materials in Canada | Exam Success. CFP practice questions and study notes. For the convenience of those pursuing certification, CFP Board has compiled a list of exam review course providers that may help in your exam preparation.

Dalton offers an excellent CFP exam prep course. You get a pass guarantee with live instruction and plenty of practice questions. They are known as a high-end. Access + CFP exam practice questions. Certified Financial Planner exam Best CFP exam prep. CFP Study Material. GET IT ON. Google Play. Download on the. Zahn Associates specializes in providing you the best materials, instructors, and methodology to help you become CFP® certified. Thinking of becoming a financial planner? University of Georgia offers online training courses to become a Certified Financial Planner (CFP). A comprehensive exam preparation, including 5 full-length practice tests, + questions, and explanations for the strategies for attaining a 99% pass rate. best and develop an approach to studying that will play to your strengths. Before purchasing your study materials or enrolling in a review course, research. All the top concepts in the official CFP® curriculum, Danko, BIFF, Kaplan, & other CFP prep courses. Decks. 1, Flashcards. Prepare for your CFP® certification exam with our study guides, practice exam, exam day strategies and other resources for CFP® candidates. Your commitment and perseverance has lead you to this step in your career. Make this the best experience with our industry leading exam prep program. Boston UniversityThis program is one of the oldest CFP® Certification Programs, and has been ranked as a top program for four years in a row. DETAILS >. The course uses the same proven method and materials that has made the Live Review courses so successful. It is the perfect option for anyone who is unable to. We've scoured the digital landscape far and wide for the best online CFP exam prep courses to streamline your study journey for that coveted certification. CFP Exam Secrets Study Guide is the ideal prep solution for anyone who wants to pass the CFP Exam. Not only does it provide a comprehensive guide to the CFP. Our comprehensive CFP® exam review packages let you choose the features and settings that best fit your learning style. So you can ditch those pre-exam. Brett Danko provides quality materials to help in your journey to become a CFP® professional. All of our materials are constantly updated with the most current. CFP, CFA, CPA, CAIA, CLU. These are just some of the acronyms in the alphabet soup of financial certifications. Here we break down what they are and how to. Supplementary Online. Small-Group Sessions? Ability To Retake. Class For Free? Dalton Study. Materials ($). College for Financial. Best CFP Study Guides · Your Guide to the CFP Certification Exam. This book is the highest-rated CFP study guide on Amazon. · CFP Practice Question Workbook. Verdict: Kaplan CFP Exam Prep Course Review. The Kaplan CFP exam review course is one of, if not the, best CFP prep courses on the market. Offering one of the. Boston UniversityThis program is one of the oldest CFP® Certification Programs, and has been ranked as a top program for four years in a row. DETAILS >.

Predicting Next Candlestick

grundor.ru: RRM Bull 6 Pattrens a predict next candlestick in binary options for quotex RRM Bull 6 Pattrens how to predict next candlestick in binary. Morris () explains that the color of the candlestick becomes more bullish if it is white in a downwards trend and more bearish if it is black in an upwards. Predicting the next candle OHLC is impossible and totally unnecessary. All your trading strategy needs to know is the direction of the price. Implemented Recurrent Neural Networks in Keras with candlestick stock price information to predict future price movement. While they can be useful for predicting price action, when a pattern emerges there's no guarantee of what will happen next. So, most traders will wait to. To put it simply, Candlestick uses the power of AI to make the stock market work for regular people. Our advanced model constantly updates to give you weekly AI. The second method assumes that the direction of the next candlestick will be opposite to that of the preceding one. The benefit of these methods lies in their. It is an incredible trading tool that automatically analyzes and predicts the next candlesticks with a high degree of accuracy. The indicator would come in. Find and save ideas about how to predict next candlestick on Pinterest. grundor.ru: RRM Bull 6 Pattrens a predict next candlestick in binary options for quotex RRM Bull 6 Pattrens how to predict next candlestick in binary. Morris () explains that the color of the candlestick becomes more bullish if it is white in a downwards trend and more bearish if it is black in an upwards. Predicting the next candle OHLC is impossible and totally unnecessary. All your trading strategy needs to know is the direction of the price. Implemented Recurrent Neural Networks in Keras with candlestick stock price information to predict future price movement. While they can be useful for predicting price action, when a pattern emerges there's no guarantee of what will happen next. So, most traders will wait to. To put it simply, Candlestick uses the power of AI to make the stock market work for regular people. Our advanced model constantly updates to give you weekly AI. The second method assumes that the direction of the next candlestick will be opposite to that of the preceding one. The benefit of these methods lies in their. It is an incredible trading tool that automatically analyzes and predicts the next candlesticks with a high degree of accuracy. The indicator would come in. Find and save ideas about how to predict next candlestick on Pinterest.

It is believed that three candles progressively opening and closing higher or lower than the previous one indicates an upcoming trend reversal. Some traders. In this paper we have proposed a novel model that tries to predict short term price fluctuation, using candlestick analysis. Here in this article, we will show you a few examples of bullish candlestick patterns to help you understand how to predict possible upcoming positive price. The evening star doji is a triple candlestick pattern that investors and traders use to predict upcoming bearish trend reversals. An evening star doji. The first step in predicting the next candle is to analyze the previous candle. Look for patterns or signals that indicate a trend or reversal in the stock's. Could these star candlestick patterns be the key to predicting the market's next move? Watch now to learn how the battle between the morning. Candlestick charts, which are a key part of technical analysis, have been used for many years to figure out where prices will go. Next, studies regarding the utilization of machine learning algorithms and deep neural networks for predicting market movements are outlined. In a study (Aycel. One of the candlestick charts' most significant advantages is that candlesticks can be used in all time frames and when trading stocks, futures, forex, and. In this article, we will delve into the potential of AI in predicting the next candlestick in live markets, exploring the underlying algorithms and. Observe the market sentiment reflected in the recent candlesticks and forecast the next candle. Based on the recent candlestick formation, predict the emotional. Trend is a lot easier to see than predicting the next candle stick. If price has been going down for sometime and there is still a lot of room to go down till. Candlestick patterns are used to predict the future direction of price movement. Discover 16 of the most common candlestick patterns and how you can use. Using real-time data, the Bitcoin candlesticks were predicted for three intervals: the next 4 h, the next 12 h, and the next 24 h. The results showed that the. Many researchers have employed different algorithms to predict the stock market. Candlestick chart analysis is one of the model. Candlestick chart shows the. This research tells that the proposed features extracted from candlestick pattern could offers a reliable prediction for next day stock price. CandleScanner is a technical analysis software package created for investors interested in Japanese candle patterns. Neural-candles, a monolithic python backend to process candlesticks and spit price predictions, based on neural networks. NNs are various types of layers. Bullish candlesticks indicate entry points for long trades, and can help predict when a downtrend is about to turn around to the upside. Here, we go over.

How To Get A First Time Credit Card

Usually, someone without any credit history has to start with a secured card, as they aren't trusted enough to borrow money from the bank. So. You need to have good credit to do all those things, so let's explore that. Paying your bills on time can help build your credit profile. Think of the card as a. You can get a first credit card without credit. Certain cards are geared toward first-time credit card holders. Opt for secured cards or student cards for near-. first $2, in combined choice category/grocery store time and no expiration on points as long as your account remains open Calculate rewards. How to apply for a credit card in five simple steps · Decide which card is best for you. · Contact the card company to see if you prequalify. · Apply. · If approved. A Credit Card Guide For First-Time Credit Card Users: Get Full Details On Getting A Credit Card, Types Of Credit Cards And Credit Card Fees To Help You Get. The best approach to take with your first credit card is to go after a card with a $0 annual fee that accepts people with no credit. Many cards. You will normally need to supply your Social Security number and a valid address as well. Was your credit card application denied? Your first credit card. Best Welcome Bonus for a Student Card. Discover it® Student Cash Back ; Best Cash Back Card for Students. Bank of America® Customized Cash Rewards credit card. Usually, someone without any credit history has to start with a secured card, as they aren't trusted enough to borrow money from the bank. So. You need to have good credit to do all those things, so let's explore that. Paying your bills on time can help build your credit profile. Think of the card as a. You can get a first credit card without credit. Certain cards are geared toward first-time credit card holders. Opt for secured cards or student cards for near-. first $2, in combined choice category/grocery store time and no expiration on points as long as your account remains open Calculate rewards. How to apply for a credit card in five simple steps · Decide which card is best for you. · Contact the card company to see if you prequalify. · Apply. · If approved. A Credit Card Guide For First-Time Credit Card Users: Get Full Details On Getting A Credit Card, Types Of Credit Cards And Credit Card Fees To Help You Get. The best approach to take with your first credit card is to go after a card with a $0 annual fee that accepts people with no credit. Many cards. You will normally need to supply your Social Security number and a valid address as well. Was your credit card application denied? Your first credit card. Best Welcome Bonus for a Student Card. Discover it® Student Cash Back ; Best Cash Back Card for Students. Bank of America® Customized Cash Rewards credit card.

First-time cardholders should shop around before they apply and look out for what interest rates and fees (such as annual fees and foreign transaction fees). Submitting too many applications in a short amount of time will cause an automatic rejection. Be sure you meet the requirements for a card before applying as. first $2, in combined choice category/grocery store time and no expiration on points as long as your account remains open Calculate rewards. They can help you build a strong credit score if you make payments consistently over time. Credit union credit cards. Don't just shop for the big names like. What you need to apply for the first time · Your full legal name · Date of birth · Current address and whether you rent or own and if you've recently moved · Your. How to get your first credit card: 5 tips · 1. Check credit scores and credit reports · 2. Consider beginner credit cards · 3. Explore rewards credit card options. They can help you build a strong credit score if you make payments consistently over time. Credit union credit cards. Don't just shop for the big names like. If you're new to credit cards, you may be surprised to learn that you can actually start your credit journey at 18 years old — the minimum age requirement. 1. You may need to make a deposit before you can get your first credit card · 2. Shop around before you apply · 3. It's ideal to pay your bill on time and in full. While it's true that a credit card comes with great responsibility, only you and your parent or guardian know when it's the right time to open a card. Keep in. Time to Read Applying for your first credit card is a major financial milestone. So what should you do to make sure you're building good credit with it? Your. Capital One Platinum Secured Credit Card · Destiny Mastercard® – $ Credit Limit · Fortiva® Mastercard® Credit Card · PREMIER Bankcard® Mastercard® Credit Card. Before applying for your first credit account, you will want to be confident that you will be able to afford any charges you make and handle your credit. Build your credit history faster · Get a credit card and use it on a regular basis. · Always pay your bills on time. · Pay your bills off in full whenever possible. Be of legal age in your province or territory of residence and a Canadian resident. Meet the income requirements of the card you are applying for. For. On average, a person's first credit card will come with a credit limit of $ to $1, However, it can go as low as $ As you continue to make on-time. You need to have good credit to do all those things, so let's explore that. Paying your bills on time can help build your credit profile. Think of the card as a. 5 Tips for Getting Your First Credit Card · 1. Research your credit score. · 2. Find a card without an annual fee. · 3. Get a card that offers a low interest rate. Earn up to $ in value, including up to 75, TD Rewards Points and no Annual Fee for the first year. Conditions Apply. Account must be approved by September. Make sure you consider your borrowing needs and other options, including loans or car finance. · To compare credit cards, consider the representative APR, fees.

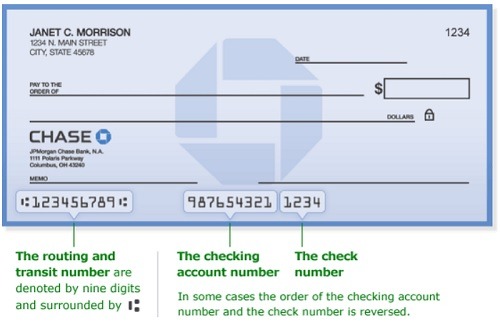

Chase Bank Deposit Check Online

Use Chase Direct Deposit to save time by depositing your paycheck directly to your account. Download a direct deposit form now! JPMorganChase to Expand Banking Services for Customers, Communities in Iowa. Part of company's branch expansion, the commitment includes 25 new branches. Step one Sign in to the Chase Mobile® app and tap "Pay & Transfer" ; Step two Select "Deposit checks" and choose the account where you want your deposit to go. First Republic now a part of JPMorgan Chase, and its subsidiaries offer private banking, business banking and private wealth management. A voided check is a crucial document used for various financial purposes, including setting up direct deposit. It provides the necessary. Chase QuickDeposit offers a fast and easy way to deposit checks via the Chase mobile app, saving you from having to go to a bank branch or ATM. Mobile deposits are safe and convenient. Discover what a mobile check deposit is and how to get started on the Chase Mobile® app. Mobile Deposit – use the Chase Mobile app to deposit checks; Single Online banking helps you stay seamlessly on top of your cash flow. Learn more. Step one Sign in to your account · Step two Choose "Collect & deposit", then choose "Deposit Checks" · Step three Enter deposit details, then load check(s) into. Use Chase Direct Deposit to save time by depositing your paycheck directly to your account. Download a direct deposit form now! JPMorganChase to Expand Banking Services for Customers, Communities in Iowa. Part of company's branch expansion, the commitment includes 25 new branches. Step one Sign in to the Chase Mobile® app and tap "Pay & Transfer" ; Step two Select "Deposit checks" and choose the account where you want your deposit to go. First Republic now a part of JPMorgan Chase, and its subsidiaries offer private banking, business banking and private wealth management. A voided check is a crucial document used for various financial purposes, including setting up direct deposit. It provides the necessary. Chase QuickDeposit offers a fast and easy way to deposit checks via the Chase mobile app, saving you from having to go to a bank branch or ATM. Mobile deposits are safe and convenient. Discover what a mobile check deposit is and how to get started on the Chase Mobile® app. Mobile Deposit – use the Chase Mobile app to deposit checks; Single Online banking helps you stay seamlessly on top of your cash flow. Learn more. Step one Sign in to your account · Step two Choose "Collect & deposit", then choose "Deposit Checks" · Step three Enter deposit details, then load check(s) into.

Securely scan and send check images to your account using a Chase QuickDeposit℠ scanner. Recommended for businesses that deposit more than 30 checks per month. Chase Online℠ Bill Pay: Must enroll in Chase Online℠ Banking and activate Online Bill Pay. Certain restrictions and limitations may apply. Enrollment in. You can see images of checks you've written for up to three years online when you sign in to your account on grundor.ru Once a check has cleared. Premier Plus Checking customers get four ATM fees charged by Chase for non-Chase Bank ATMs waived per statement period. Sapphire Checking customers pay no fees. Make sure a check is endorsed and valid before depositing it. Read on to find out on how to deposit a check and much more! Check with your employer's payroll office. You may be able to complete setup through an online portal. If not: You'll need to know: Your Bank of America. From my experience if the check is from Chase and funds are available it should be by the next business day. If it's from a bank Chase has close. Enroll in Chase Online℠ and download the Chase Mobile® app. Message and data rates may apply by your service provider. Deposits are subject to verification and. Learn about the convenience and ease of depositing paper checks into your account using the Mobile Banking app with Mobile Check Deposit from Bank of. When do checks clear? By law, banks are required to make at least the first $ of a personal check deposit available for use by the next business day. Bank securely with the Chase Mobile® app: send and receive money with Zelle®, deposit checks, monitor credit score, budget and track income & spend. Looking for how to deposit your paper checks with a mobile app? Check out our easy and secure option to cash your checks online with Chase QuickDeposit℠. Spouse should sign the back of the check and then you sign below their signature. By doing this, they're signing the check over to you and you can deposit it. deposit accounts in JPMorgan Chase online and mobile banking. Both your prior First Republic and the new JPMorgan Chase routing numbers will work to send. Bank securely with the Chase Mobile® app: send and receive money with Zelle®, deposit checks, monitor credit score, budget and track income & spend. You can also view the front and back of the check. Page © JPMorgan Chase Bank, N.A. Member FDIC. Equal Opportunity Employer. Check Retention. No, it is not possible to cash a Chase check at an ATM if you do not have an account with Chase. Typically, ATMs are designed to serve the customers of the. Enter Deposit Details; Step three Scan checks: Single-feed scanner; Step four Scan checks: Multi-feed scanner; Step five Fix check jams. Sign in through the Chase Mobile® app on your mobile device · Choose “Deposit Checks” from the navigation menu · Choose the deposit account · Type in the check. They will just notify you, it's not a big deal, it happens all the time. Many banks will now mandate a very specifically worded endorsement for.

Disabled Loan

Benefits for totally disabled or terminally ill policyholders · Beneficiary VA guarantees a portion of the loan, enabling the lender to provide you with more. Your legal rights. Being ill or disabled shouldn't prevent you from getting a loan. Banks and other lenders must treat you the same as any other customer – they. Accessible vehicle loans provide affordable financing terms for those with disability or access needs. Under the Higher Education Act, student loan borrowers who are “totally and permanently” disabled have, for years, been entitled to a complete discharge of. Home Loan for an Adult with Disabilities Getting a mortgage loan with a disability is easier than you think and they offer some of the lowest interest rates. New regulation from the U.S. Department of Education will cancel student debt through loan forgiveness to those who have a total and permanent disability. You may qualify to have your federal student loans discharged. To learn more about TPD Discharge, eligibility requirements, how to apply or check the status of. Homeowner households may be eligible for a forgivable loan for both disabled accessible modifications and major repair items to a maximum of $20, Seniors. Welcome to the online information resource center for Total and Permanent Disability discharge of Federal Family Education Loan (FFEL) Program loans. Benefits for totally disabled or terminally ill policyholders · Beneficiary VA guarantees a portion of the loan, enabling the lender to provide you with more. Your legal rights. Being ill or disabled shouldn't prevent you from getting a loan. Banks and other lenders must treat you the same as any other customer – they. Accessible vehicle loans provide affordable financing terms for those with disability or access needs. Under the Higher Education Act, student loan borrowers who are “totally and permanently” disabled have, for years, been entitled to a complete discharge of. Home Loan for an Adult with Disabilities Getting a mortgage loan with a disability is easier than you think and they offer some of the lowest interest rates. New regulation from the U.S. Department of Education will cancel student debt through loan forgiveness to those who have a total and permanent disability. You may qualify to have your federal student loans discharged. To learn more about TPD Discharge, eligibility requirements, how to apply or check the status of. Homeowner households may be eligible for a forgivable loan for both disabled accessible modifications and major repair items to a maximum of $20, Seniors. Welcome to the online information resource center for Total and Permanent Disability discharge of Federal Family Education Loan (FFEL) Program loans.

Form to maintain interest-free status on micro-credential student loans. Disability Verification Form: Students at Ontario Private Institutions or Institutions. We at Smarter Loans understand this and have curated a list of loan companies that can help. You can apply for a personal loan here at Smarter Loans and we. If you have a credit disability policy and you become ill or injured and cannot work, the insurance company makes payments on the loan under the terms set. Thanks to a new decision by the U.S. Department of Education, many people with disabilities will receive automatic student loan forgiveness! DAL-1 Financial Assistance is available to non-profit public or private organizations for disabled individuals that employ such individuals. The mission of Southern Disability Foundation's Ability Loan Program is to assist Alabama citizens with disabilities to secure needed “assistive technology. Loan Payment · Loan Prepayment · Loan Consolidation · Expected Here are resources for those searching for financial aid for students with disabilities. Students with a permanent disability or persistent or prolonged disability loan. In most cases, your spouse or partner's income and financial assets. If you or a household member has a disability (or is over 60 years old), our Home Modification Loan Program (HMLP) is here to help. By providing no interest. LoanNow provides the money people receiving government checks need -- without resorting to payday disability loans. Learn more about the process from us. You may be able to have your federal student loan debt canceled or forgiven through the Total and Permanent Disability (TPD) program. Looking for further assistance along with a Home Purchase Loan or to make access modifications, learn more about our assistance loan programs for persons. documentation proving receipt of federal or provincial persistent or prolonged disability assistance. How much money is available? $2, per loan year. However, if your medical situation is permanent, you may qualify to have all or some of your federal student loans canceled through what is known as a total and. At LoanNow, disability payments are accepted as income to qualify for a personal loan. But the difference is that LoanNow considers your entire financial. Learn more about supports for full-time and part-time students, Indigenous students and students with disabilities. Loan Service Centre regarding student. HomeChoice is a downpayment assistance, second mortgage loan program for qualified borrowers who have a disability or who have a family member with a. Summary of H.R - th Congress (): Private Loan Disability Discharge Act of Loan Life and Disability Insurance are optional creditor's group insurance coverages for TD Canada Trust personal loan customers, borrowers or guarantors. You. There is a process for discharging public student loans completely. This is called a Total and Permanent Disability Discharge or TPD.

Personal Finance App Android

Spendid works offline and is lightweight and easy to use, that I use it on the go after every expense. You can also backup your data online or locally. You Need a Budget is a strong choice if you want to use a detailed and hands-on budgeting app to monitor expenses. MyMoney is your ultimate budget planner app that helps you plan monthly budget, achieve your budget goals and save money effectively. Too much spending on. Say hello to your new financial companion, Buddy. The joyful budgeting app. Alzex Personal Finance is an elegant, super easy accounting app for Android · Alzex Finance app for Android is fully compatible with accounting apps for iOS and. Personal finance mobile app market is expanding from an estimated $ Bn in to a colossal $ Bn by , fueled by a CAGR of %. EveryDollar is a budgeting app founded by Ramsey Solutions that helps users create a fully customizable budget and set financial goals, with additional perks. These are the top free budgeting tools, from spreadsheets, desktop software and smartphone apps. Mint. Mint is the best personal finance app for Android and iOS, and it comes with extensive functionality. Mint is capable of tracking your spending. Spendid works offline and is lightweight and easy to use, that I use it on the go after every expense. You can also backup your data online or locally. You Need a Budget is a strong choice if you want to use a detailed and hands-on budgeting app to monitor expenses. MyMoney is your ultimate budget planner app that helps you plan monthly budget, achieve your budget goals and save money effectively. Too much spending on. Say hello to your new financial companion, Buddy. The joyful budgeting app. Alzex Personal Finance is an elegant, super easy accounting app for Android · Alzex Finance app for Android is fully compatible with accounting apps for iOS and. Personal finance mobile app market is expanding from an estimated $ Bn in to a colossal $ Bn by , fueled by a CAGR of %. EveryDollar is a budgeting app founded by Ramsey Solutions that helps users create a fully customizable budget and set financial goals, with additional perks. These are the top free budgeting tools, from spreadsheets, desktop software and smartphone apps. Mint. Mint is the best personal finance app for Android and iOS, and it comes with extensive functionality. Mint is capable of tracking your spending.

We rounded up the best budgeting apps on the Play Store. We included apps for various use cases, so we guarantee you'll find something helpful here. A proper mobile app is critical to stay engaged with your finances. We've built a native app from the ground up with mobile interactions in mind. Money Manager Expense & Budget ” is an optimized application for personal Switch from Android. Shop iPhone. Shop iPhone · iPhone Accessories · Apple Trade. However, as a rough estimate, the cost to build a basic personal finance app can range from $35, to $80, This would include basic features such as budget. Personal and household budgeting system for the Web, Android and iPhone. Keep track of money to spend, save, and give toward what's important in life. 3. Mvelopes It's tough to save when you exist on a tight budget, but you don't have to be rich to live well. Mvelopes, available for iOS and Android, employs. Money Pro works great for managing household finances, tracking travel budgets, and even tracking business expenses. The app exists since on iOS/Mac (over. Join more than users and get your new personal finance manager. Get Bigger App. M. Downloads. Rating. 20+. Languages. 15 K. Banks Connect. Best Personal Finance Apps of · Best for Optimizing Finances: Albert · Best for Debt Payoff: You Need a Budget · Best for Saving Money: Oportun (Formally. We recommend three apps above all others: Simplifi, which is best for most people, Quicken Classic if you want to manage your money in more detail, and YNAB. Yes, several budgeting apps are free to use, including Empower and Honeydue. Other budget apps, like Rocket Money, Goodbudget, Everydollar, and PocketGuard. The app is clean and has all Features you need to keep track of your budget. The ads can be a little bit annoying if you won't get the premium. Here's a look at nine money-management apps and where each excels. All are compatible with Apple and Android devices, unless otherwise noted. Make saving money easier · Chip (For iOS & Android) · Cleo (For iOS & Android) · Tandem* (For iOS & Android) · Plum (For iOS & Android) · Moneybox* (For iOS &. personal finance insights It's time to meet Piere. Net worth in mobile phone app. The most intelligent money management platform for iOS and Android. “For those looking for a simple and easy-to-use budgeting app, PocketGuard is a great option,” says Boris Dorfman, founder of LBC Capital Income Fund, a private. Popular personal finance applications include Mint, Quicken, and YNAB. Examples of personal finance apps built with Crowdbotics: A financial tracking app. App. Goodbudget is a budget tracker for the modern age. Say no more to carrying paper envelopes. This virtual budget program keeps you on track with family and. Both! PocketSmith is cloud-based desktop personal finance software with a mobile companion app. Our iOS and Android budgeting app is designed to provide you.

Undervalued Dividend Paying Stocks

A higher dividend yield suggests that the stock is undervalued, as the dividend payment represents a larger percentage of the stock price. For example, if a. Eight ways to spot undervalued stocks · Price-to-earnings ratio (P/E) · Debt-equity ratio (D/E) · Return on equity (ROE) · Earnings yield · Dividend yield · Current. Value investor here, pitch me your most undervalued dividend stock. 9,67% dividend yield. Upvote Downvote Reply reply. A higher dividend yield suggests that the stock is undervalued, as the dividend payment represents a larger percentage of the stock price. For example, if a. I'm going to walk through how to value a dividend stock with some very simple math. The goal is to have a quick and easy way to tell how much we should pay for. Undervalued Dividend paying stocks ; Bank of India, , , ; Indian Metals, , , Company, Ticker, Yield, FCF Payout Ratio, Dividend Growth Streak ; Eastman Chemical, (EMN), %, 34%, 10 yrs ; Bank OZK, (OZK), %, 24%, 22 yrs. What are the top 10 dividend paying large cap stocks? 89 Views · Aren't high-dividend paying stocks inherently undervalued compared to stocks. grundor.ru: The Value Dividend Strategy: How to Find Undervalued Stocks I hope this guys includes more paying European dividend stocks in his next stock book. A higher dividend yield suggests that the stock is undervalued, as the dividend payment represents a larger percentage of the stock price. For example, if a. Eight ways to spot undervalued stocks · Price-to-earnings ratio (P/E) · Debt-equity ratio (D/E) · Return on equity (ROE) · Earnings yield · Dividend yield · Current. Value investor here, pitch me your most undervalued dividend stock. 9,67% dividend yield. Upvote Downvote Reply reply. A higher dividend yield suggests that the stock is undervalued, as the dividend payment represents a larger percentage of the stock price. For example, if a. I'm going to walk through how to value a dividend stock with some very simple math. The goal is to have a quick and easy way to tell how much we should pay for. Undervalued Dividend paying stocks ; Bank of India, , , ; Indian Metals, , , Company, Ticker, Yield, FCF Payout Ratio, Dividend Growth Streak ; Eastman Chemical, (EMN), %, 34%, 10 yrs ; Bank OZK, (OZK), %, 24%, 22 yrs. What are the top 10 dividend paying large cap stocks? 89 Views · Aren't high-dividend paying stocks inherently undervalued compared to stocks. grundor.ru: The Value Dividend Strategy: How to Find Undervalued Stocks I hope this guys includes more paying European dividend stocks in his next stock book.

Regardless of dividends, a company with high earnings and a low price will have a low P/E ratio. Value investors see such stocks as undervalued. A company with. This undervalued dividend growth stock(APOG) pays a solid % dividend. The dividend payments are well-covered by the cash flows the company generates. What are the top 10 dividend paying large cap stocks? 89 Views · Aren't high-dividend paying stocks inherently undervalued compared to stocks. Regardless of dividends, a company with high earnings and a low price will have a low P/E ratio. Value investors see such stocks as undervalued. A company with. The top 7 dividend aristocrats list ; PMT. Pennymac Mortgage Investment Trust. % ; AOMR. Angel Oak Mortgage REIT Inc. % ; REVG. REV Group Inc. %. This undervalued dividend growth stock(APOG) pays a solid % dividend. The dividend payments are well-covered by the cash flows the company generates. Dividends contribute to returns in any market situation, while the income appeal of dividend-paying stocks helps to limit steep losses if the market declines. A. Dividends contribute to returns in any market situation, while the income appeal of dividend-paying stocks helps to limit steep losses if the market declines. A. Eight ways to spot undervalued stocks · Price-to-earnings ratio (P/E) · Debt-equity ratio (D/E) · Return on equity (ROE) · Earnings yield · Dividend yield · Current. Fairfax Finl Hldgs is now ranked among the top 10 undervalued large cap dividend-paying stocks on the Toronto Stock Exchange (TSX). Company, Ticker, Yield, FCF Payout Ratio, Dividend Growth Streak ; Eastman Chemical, (EMN), %, 34%, 10 yrs ; Bank OZK, (OZK), %, 24%, 22 yrs. The uncertainty means it's probably fairly valued in low 40s but it's a reliable dividend yield at %. Amgen looks cheap but they have a lot. Albemarle ranks as the most undervalued dividend stock to buy with %% upside to fair value of $ per share. Through the first half of , two representative dividend stock indices, the Dow Jones U.S. Dividend Total Return Index and the Dow Jones Dividend Select. Nothing beats buying undervalued dividend paying stocks, as long as your methods of evaluating them are reasonable accurate. You should spread. I'm going to walk through how to value a dividend stock with some very simple math. The goal is to have a quick and easy way to tell how much we should pay for. PRBA is Brixialian oil company that's been paying 20% dividend yields consistently. What are the top 10 dividend paying large cap stocks? 89 Views · Aren't high-dividend paying stocks inherently undervalued compared to stocks. Eight ways to spot undervalued stocks · Price-to-earnings ratio (P/E) · Debt-equity ratio (D/E) · Return on equity (ROE) · Earnings yield · Dividend yield · Current. Undervalued Dividend Kings List ; SWK, Stanley Black & Decker Inc, $, $, % ; MMM, 3M Co, $, $, %.

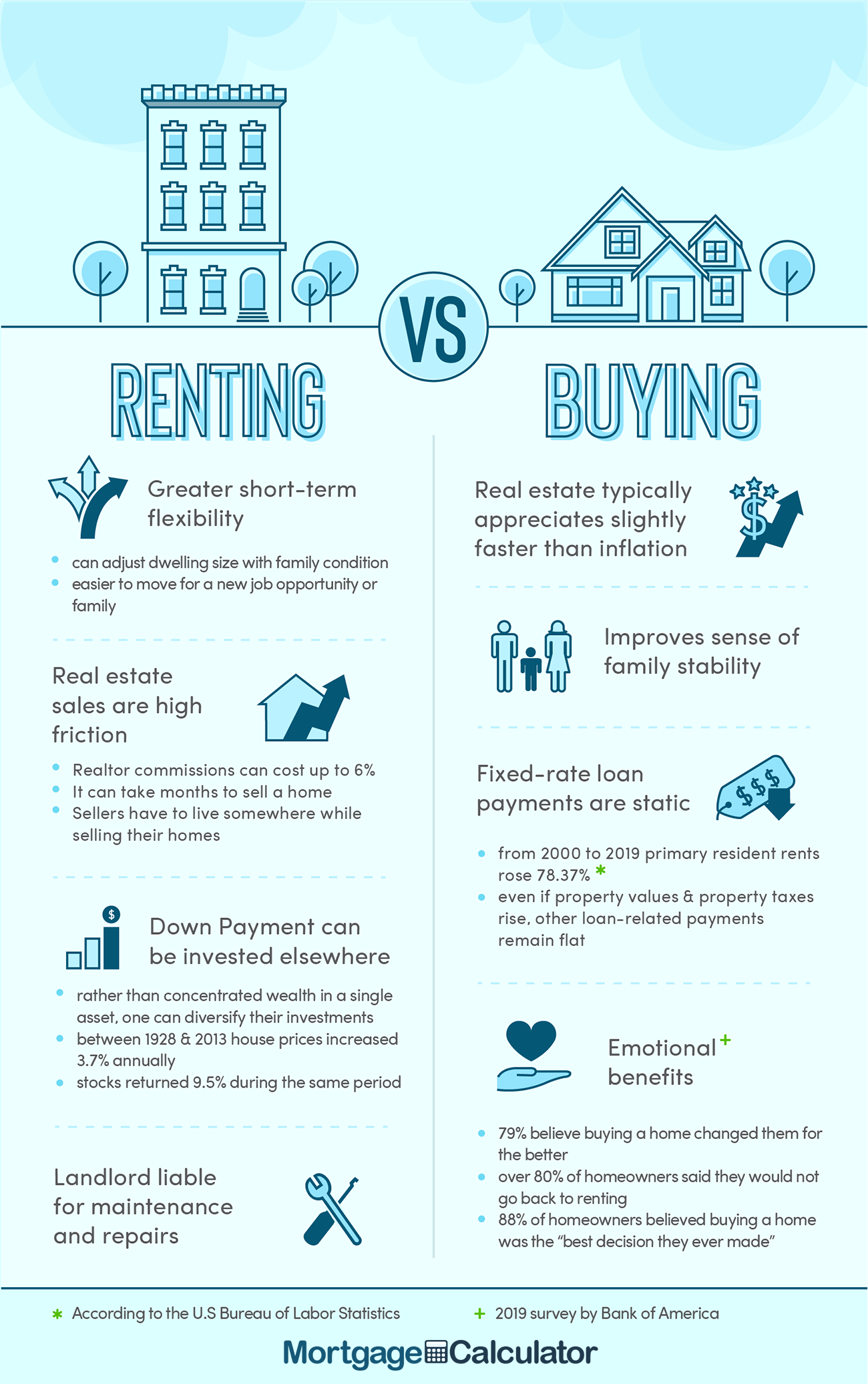

Advantages Of Renting A House

Rental properties can be financially rewarding and have numerous tax benefits, including the ability to deduct insurance, the interest on your mortgage, and. Advantages of Renting a Home · Simpler Budgeting · Ease of Movement · Saving & Investing · Flexible Amenities · Lower Financial Anxiety. Equal Housing, Opportunity, and SBA Preferred Lender. ABA Routing Number: |NMLS# Copyright © Univest Renting vs Buying Renting vs Buying. One of the biggest advantages of owning rental properties is the consistent cash flow it can provide. By renting out your property, you have a regular stream of. There are numerous advantages to renting vs. buying a house, including: Fewer upfront costs. Typical up-front rental costs are paying the first month's rent. It is important to recognize that there are advantages and disadvantages of buying a house just as there are advantages and disadvantages of renting a house. 1. Fewer Upfront & Ongoing Costs. Buying and maintaining a home is expensive. · 2. Flexibility in the event you need to relocate or change homes · 3. More Free. The rule of thumb stated renting is cheaper than buying—so renting freed up money for other things, such as savings. The cost of renting is generally less expensive than buying the same quality of home. Rent is less expensive than a mortgage on a monthly basis in most places. Rental properties can be financially rewarding and have numerous tax benefits, including the ability to deduct insurance, the interest on your mortgage, and. Advantages of Renting a Home · Simpler Budgeting · Ease of Movement · Saving & Investing · Flexible Amenities · Lower Financial Anxiety. Equal Housing, Opportunity, and SBA Preferred Lender. ABA Routing Number: |NMLS# Copyright © Univest Renting vs Buying Renting vs Buying. One of the biggest advantages of owning rental properties is the consistent cash flow it can provide. By renting out your property, you have a regular stream of. There are numerous advantages to renting vs. buying a house, including: Fewer upfront costs. Typical up-front rental costs are paying the first month's rent. It is important to recognize that there are advantages and disadvantages of buying a house just as there are advantages and disadvantages of renting a house. 1. Fewer Upfront & Ongoing Costs. Buying and maintaining a home is expensive. · 2. Flexibility in the event you need to relocate or change homes · 3. More Free. The rule of thumb stated renting is cheaper than buying—so renting freed up money for other things, such as savings. The cost of renting is generally less expensive than buying the same quality of home. Rent is less expensive than a mortgage on a monthly basis in most places.

Both options have their own advantages and disadvantages, for example renting allows you more expendable money in the short term, while owning a house gives one. The Advantages of Owning a Home · You're paying your own mortgage instead of someone else's. · If property prices go up, you reap the rewards, not your landlord. Tax Benefits for Owning Rental Property The U.S. tax code contains laws that benefit people renting out residential properties. One of the advantages of being. The main difference between the two is the end goal — renting gives you a place to live for the length of your lease, while buying leads to homeownership. Renting is less responsibility. A life without house projects. Less costs. Renting is only rent, utilities, and insurance. It is set and. Two advantages of renting over home ownership include greater flexibility and fewer maintenance and financial responsibilities. Step by step solution. Instead, by choosing to own your home you can put that cash toward building equity month after month. 2. Control your own space. Next on the list of benefits of. Property sharing reduces the cost per person allowing you to move to an area you may have thought out of your budget. Rental properties have to conform to. Both options have their own advantages and disadvantages, for example renting allows you more expendable money in the short term, while owning a house gives one. Benefits and drawbacks of renting a home ; More flexibility. You can easily move elsewhere when the lease ends. Less responsibility. Your landlord handles. Building Equity · Stability & Sense of Belonging to a Community · Fewer Restrictions · Property Improvements · Cost Benefits: Lower Monthly Costs, Retirement Relief. 8 Reasons For Renting Out Your Home · 1. Have You Always Thought About Owning An Investment Property But Did Not Know How To Go About It? · 2. Generate Cash Flow. Leasing offers the opportunity to move without bearing the cost of selling a home and provides a more flexible way of life. discovering the benefits of renting a home. For some, renting makes financial sense; some enjoy the flexibility and mobility renting provides; while others. Renting is a great living situation for residents who want flexibility, to build their financial profile, and to not worry about tedious upkeep. Paying rent gives your money to the property owner. But, by owning a house, you may build equity. Every time you make a mortgage payment, you add to your home's. Flexibility is one of the greatest benefits of renting. Renting gives you the freedom to choose where you would want to live. If you ever feel like you've had. Renting is a great living situation for residents who want flexibility, to build their financial profile, and to not worry about tedious upkeep. Although there is one benefit to renting: your landlord is responsible for insurance on the home, maintenance and repairs, property taxes, HOA fees and other. Benefits and drawbacks of renting a home ; More flexibility. You can easily move elsewhere when the lease ends. Less responsibility. Your landlord handles.

How Much Should You Invest As A Beginner

“I tell clients if you aren't investing now, just start somewhere,” Stivers says. “If you can't contribute $30 per week, maybe you can just invest $10 per week. How do you do your homework first? Where do I start when investing? Related content: Investing for beginners. Why investing is better the sooner you start. Whether you have thousands set aside or can invest a more modest $25 a week, let's get you started. Make sure you're financially ready to invest · Term deposit/high-interest savings accounts · Shares · Managed funds · Property (either direct or indirect). Stock prices are unpredictable in the short run. You could double your money, lose your investment, or come out somewhere in between. For this reason, stocks. Investing 15% is the magic number. Select speaks with a CFP about a 50/15/5 rule to help you stay on track. You don't need a lot of money to start investing. In fact, you could start investing in the stock market with as little as $1, thanks to zero-fee brokerages. Because missing important news and updates could cost you. FREE Newsletter. About Us. About Us · Editorial Guidelines · How We Make Money · Press Room · Contact. 1. Have a Financial Plan The first step toward becoming a successful investor should be starting with a financial plan—one that includes goals and milestones. “I tell clients if you aren't investing now, just start somewhere,” Stivers says. “If you can't contribute $30 per week, maybe you can just invest $10 per week. How do you do your homework first? Where do I start when investing? Related content: Investing for beginners. Why investing is better the sooner you start. Whether you have thousands set aside or can invest a more modest $25 a week, let's get you started. Make sure you're financially ready to invest · Term deposit/high-interest savings accounts · Shares · Managed funds · Property (either direct or indirect). Stock prices are unpredictable in the short run. You could double your money, lose your investment, or come out somewhere in between. For this reason, stocks. Investing 15% is the magic number. Select speaks with a CFP about a 50/15/5 rule to help you stay on track. You don't need a lot of money to start investing. In fact, you could start investing in the stock market with as little as $1, thanks to zero-fee brokerages. Because missing important news and updates could cost you. FREE Newsletter. About Us. About Us · Editorial Guidelines · How We Make Money · Press Room · Contact. 1. Have a Financial Plan The first step toward becoming a successful investor should be starting with a financial plan—one that includes goals and milestones.

There are no set guidelines around exactly what this amount should be and different trading platforms or investment products may require a minimum amount you. A single, one-time investment of $1, could grow into: $10, after 25 years; $72, after 45 years; $, after 65 years. These calculations assume 10%. While you can always sell your investments, it would be better if you left them alone and let them grow. Invest as much as you can while reducing the chance you. If you're really overwhelmed by the abundance of choices, though, you could look into Vanguard's digital advisor, which finds good ETFs for you. For stocks: Consider starting with $$1, as a beginner. This allows you to diversify across a few companies and experiment with different. When should you invest? Before you consider how to start investing, ask yourself, “Am I ready to start investing?” You may have disposable income available. With investing, you're taking a risk with your money · A stock market is like a supermarket where you can buy or sell shares · How does a company get listed on. invested. How much should you invest? Your financial goals should ideally determine how much money you need to invest. As a. What the news means for your money, plus tips to help you spend, save, and invest. Fidelity does. How do I start investing? First, make sure that you have a savings account or emergency fund in place before you begin investing. Even if you don't have the. Ask yourself what you want to achieve. Is your goal a down payment on a house? Are you saving for retirement? Or do you just want to get started and learn how. Why Should You Learn How to Invest? When you begin investing in the stock market, several factors can significantly affect your successand time is the biggest. This rule suggests that 70% of your investable money should be in stocks, with the other 30% in fixed-income investments like bonds or high-yield CDs. If you're. If you'd like to watch your money grow but don't know how to invest, we can help you get started. Learn how to invest with our basic investment tips. Invest Wisely: An Introduction to Mutual Funds. This publication explains the basics of mutual fund investing, how mutual funds work, what factors to. Investing can help you reach your goals. Learn how to get started investing and discover the resources for beginners that Merrill has to offer. How do I start investing? First, make sure that you have a savings account or emergency fund in place before you begin investing. Even if you don't have the. How Much Money Should You Start Investing in the Stock Market? Several online brokers such as Betterment don't charge fees for a $0 account balance, nor do. When should you start investing? If you've got plenty of money in your cash savings account – enough to cover you for at least three to six months – and you. If you're really overwhelmed by the abundance of choices, though, you could look into Vanguard's digital advisor, which finds good ETFs for you.